Apple’s Record $110 Billion Buyback Sends Stock Soaring: Quarterly Results Beat Expectations

Introduction

Investors worldwide were taken aback by latest quarterly report from Apple Inc. (AAPL.O). Company’s results significantly beat analysts’ expectations and Apple’s beloved leader, Tim Cook, announced share buyback worth $110 billion. An immediate illustration of investor confidence, Apple’s stock rose 6% in extended trading session, thus indicating market’s optimism that the company still has a way out of recent challenges. In this detailed review, the author focuses primarily on Apple’s quarterly earnings, the buyback practice and the general market dynamics which effect Apple’s future.

Apple’s Stellar Performance

Apple has refuted rumors of slowing iPhone demand being a weak segment of its business and high competition. The company exceeded market projections, with a mild 4% drop. In accordance with a CEO’s optimistic view and powerful revenue guidance, Tim Cook is expected to drive the shares of Apple which indicates the revenue growth rate is going to rise. One of the most prominent elements was that after the announcement about the earnings, Apple saw its market capitalization stage an astonishing increase, crossing over $160 billion and reflecting renewed investor interest in the tech giant.

Record-Breaking Buyback Program

Apart from the largest-ever share buyback program worth $110 billion, one of the things that people talked about most in Apple’s earnings report was the position at which its stock ended the session, down 16 points and 3% right at 526.08 per share. Through its financial flexibility, Apple indicates to a wise choice which could provide long-term return to shareholders and funding conditions at the same time. This repurchase program is seen to lift Apple’s stock price price making investors confident of the market sometimes plagued with volatility.

Navigating Market Challenges

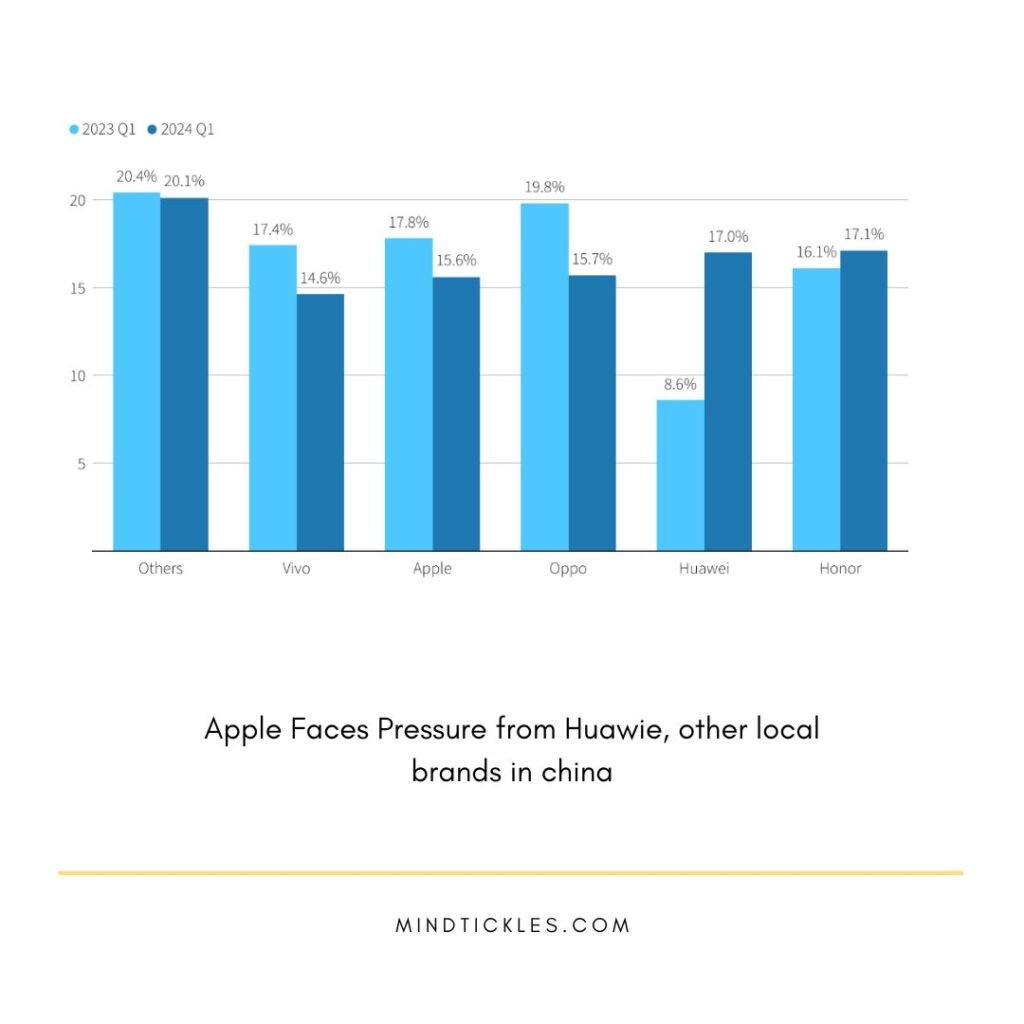

Apple faces several stiff challenges in its current competitive environment. Importantly, the competitors like Samsung Electronics (005930.KS) and Huawei Technology (HWT.UL) always remain on the heel of the Apple, especially in crucial markets such as China. Regulatory oversight, including antitrust lawsuits & laws, still represent a major element that influences the enterprise landscape at Apple. In spite of this, Apple is still successfully weathering the storm, with its service branch developing to become the major product line in the face of the bigger market threats.

Focus on Services and Implementing New and Reutilizing Ideas

Apple is taking the advantage of the changing market patterns and concentrating on its service business more than ever. Some of its services like App Store, and unique innovations like Apple Music and TV are looking profitable. CFO Luca Maestri anticipated a double-digit growth in revenues from services and iPad lines that act as a token for Apple’s strategic shift towards sustainable revenue streams. In addition to all of this, Tim Cook, Apple’s CEO, focuses his investments in R&D mainly on generative AI with a clear intention to keep Apple on the top list of innovative hi-tech companies to guarantee future growth and development.

Implications for Investors

Apple stock gain was caused by a combination of its vast purchase program and the high performance that they achieved despite the economic downturn, so investors can find a good opportunity in investing in it here. According to the analysts the proposed repurchase of the company is among the top regarded strategic maneuvers aimed at engendering a favorable relationship with the shareholders thereby securing the company’s long term growth trajectory. Even though the Apple stock price has experienced retractions, nonetheless, it is a key investment for many portfolios, giving stability and room for growth under market instability.

Conclusion

Apple, the renowned iPhone maker, has demonstrated remarkable resilience and strategic prowess, as reflected in the latest quarterly report. Under the leadership of CEO Tim Cook, Apple shares have surged, and the company’s current quarter results have shown robust revenue growth. This is a testament to Apple’s ability to innovate and adapt, continuing a legacy of excellence that has defined the company’s history.

The impressive performance this quarter, coupled with a record share buyback program worth billions, has significantly boosted the stock market value of Apple. The company’s focus on iPad revenue and overall revenue growth, despite low expectations, underscores its strong market position. This growth is further driven by the successful fiscal second quarter, with noteworthy contributions from iPhone sales and Mac sales, highlighting Apple’s dominance in the smartphone market.

Compared to the year-ago fiscal second quarter, Apple has shown a strategic shift towards services, achieving double-digit growth in this segment. This move, along with a significant cash dividend, reassures Wall Street of Apple’s commitment to shareholder value. Despite regulatory challenges and stiff competition, especially in the smartphone market, Apple has maintained its market share. The Cupertino, California company’s signature product lines, including iPhone, iPad, and Apple Watches, continue to perform well.

Analysts had set high expectations, yet Apple exceeded average analyst estimates, reinforcing confidence in its future prospects. The company’s investment in generative AI and innovative technologies is poised to drive further growth. According to LSEG data, the market’s response, including a significant billion-dollar surge, reflects strong investor sentiment. As Apple navigates the complexities of the current-quarter services market and addresses regulatory challenges, it remains a beacon of innovation and market leadership.

In conclusion, Apple’s strategic initiatives, such as the record share buyback program, have positioned the company favorably against low-single digits market growth rates. The additional program initiatives and consistent revenue growth emphasize Apple’s potential for sustained long-term growth. Analysts and investors alike can look forward to Apple’s continued success and market influence, driven by its unwavering commitment to excellence and innovation or another words, Apple’s shining results and strategic initiatives further confirm its market-leading position and establish it as a standard that other counterparts want to follow time and again in the tech sector. As the iPhone maker and a company with a rich history, Apple has seen its shares benefit greatly under the leadership of CEO Tim Cook. The latest earnings report for Apple’s current quarter demonstrated significant revenue growth, surpassing average analyst estimates and boosting the company’s stock market value. Apple’s current-quarter services, along with the iPad and Mac sales, have shown robust performance.

In particular, Apple’s quarterly revenue saw a substantial rise, which was buoyed by a billion buyback program. This record share buyback program reflects the company’s confidence and commitment to returning value to its shareholders. Despite low expectations, Apple’s overall revenue and iPhone sales remained strong, with the company navigating the smartphone market successfully. Comparing it to the year-ago fiscal second quarter, Apple executives have managed to achieve double-digit growth, contributing to a significant surge in stock value.

Moreover, the cash dividend and additional program initiatives have made Apple a preferred investment on Wall Street, ensuring stability and growth in market share even amidst stiff competition. The company has faced its share of regulatory challenges but continues to leverage its strengths, such as the Cupertino, California company’s signature product, the iPhone, and innovative services including Apple Watches and generative AI.

With analysts closely watching, Apple’s success in the fiscal second quarter, reflected in the LSEG data, reaffirms the company’s resilience. Tim Cook’s focus on generative AI and the company’s strategic investments indicate a promising future. Apple’s ability to maintain its leadership despite market pressures and regulatory challenges showcases its ability to innovate and thrive, making it a beacon in the tech industry.

For More Technology News Visit Mind Tickles